What You Need to Know About Events Going Forward: New EventMB Research

Skift Take

The list of safe-to-meet GMID 2021 events can be found here.

Where We Are

It’s no secret that the pandemic has negatively impacted the event industry, and our data confirm this. Only 18 percent of respondents report no negative impact on business, with sadly 6 percent reporting company closures.

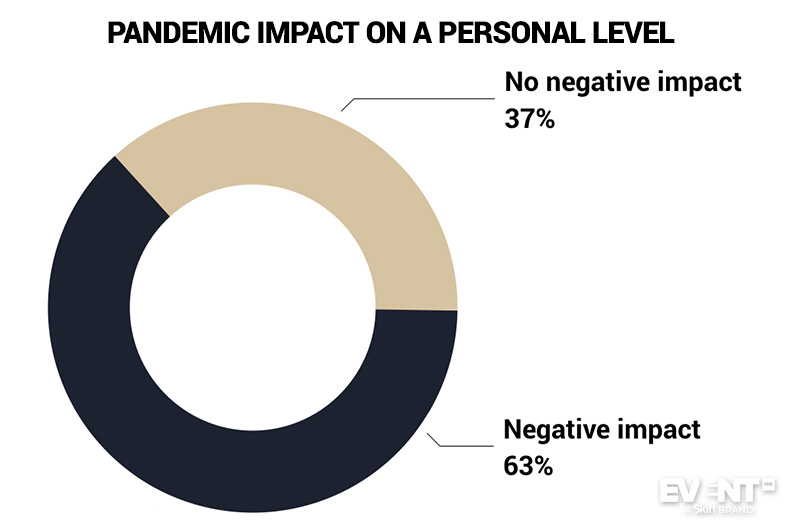

On a personal level, the numbers are slightly less negative with 37 percent reporting no negative impact, but the vast majority (63 percent) having personally felt a negative impact which includes loss of income, furlough, job loss, and closure of their own business. Financial assistance from the government has been received by 48 percent of respondents, however, almost two-thirds (65 percent) consider it to be insufficient.

Despite the challenges, 32 percent have been able to put on in-person events since the start of the pandemic, and 24 percent within the last six months. The concern over the safety of attendees and stakeholders is by far the biggest barrier to resuming in-person events; travel limitations and lack of financial viability round off the top three.

When asked about their own personal comfort level in attending events, roughly a third (36 percent) of respondents said they are not quite ready to return to in-person meetings, with a similar number (32 percent) only open to participating in small local meetings.

The Pivot to Virtual

We’ve discussed the pivot to virtual at length — we’ve even run an event about it — but new data is always welcome as the possibility of hosting in-person events changes around the world.

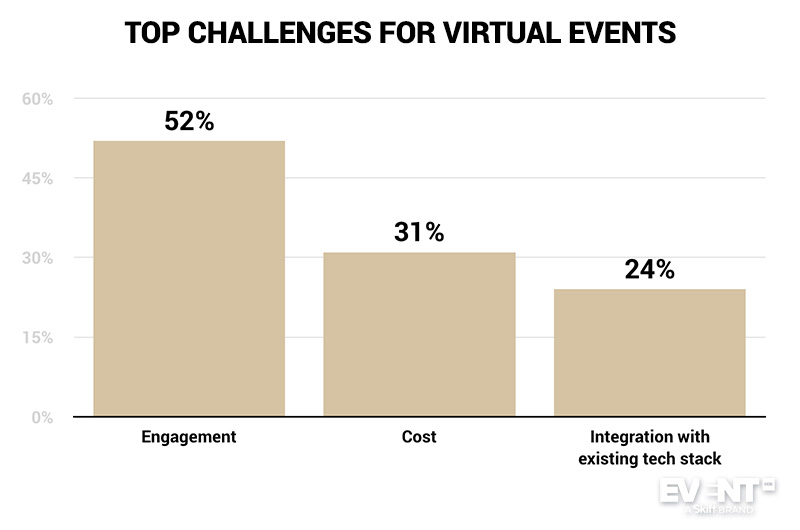

Engagement for virtual events continues to be listed as the top challenge, with cost and integrating with an existing tech stack closing up the top three.

The increased (potential) reach of virtual events is the most positive impact of the pivot to virtual: 40 percent selected this as their top choice. However, when asked about the change in attendance of their own events, only 44 percent saw an increase. Almost as many, 39 percent, saw a decrease, and 17 percent saw no change.

The attendance issue is worth unpacking. One explanation for it that virtual events may theoretically have an unlimited potential reach, in practice, this is not the case. Audience sizes, particularly for B2B events are very unlikely to grow exponentially but rather increase linearly as events attract attendees in different regions as well as those who are able to afford reduced virtual event pricing. Increased competition, with all virtual events, in theory, being global, may also play a part. There is also less standardization when it comes to virtual events so formats, lengths, and speaker setups are mostly unproven. There could also be an argument for measuring this differently because of the much higher rate of no-shows, particularly for free virtual events.

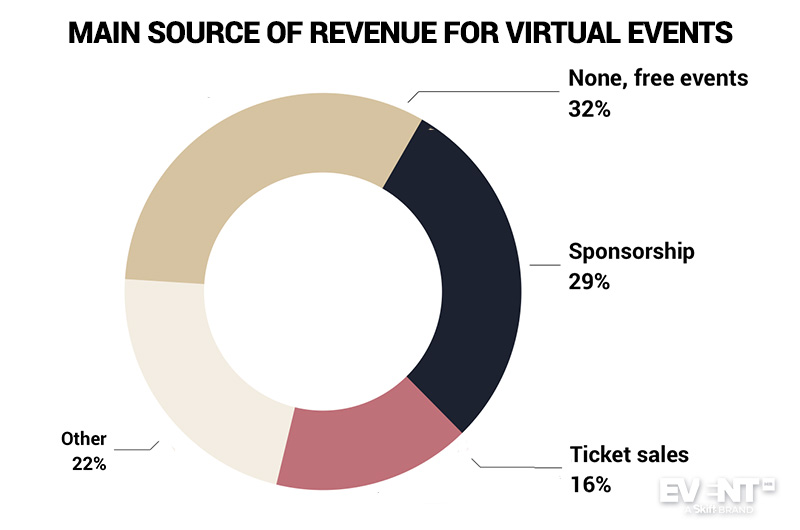

Also concerning is that the most selected main source of revenue for virtual events is “none, free events” with 32 percent. While sponsorship (29 percent) and ticket sales (16 percent) are not too far behind, it is good to note that 31 percent of respondents did confirm a profitable virtual pivot, and 13 percent even exceeded expectations.

Recouping lost revenue through virtual events is immensely challenging, with a massive 75 percent stating that their recouped amount is 50 percent or less. Only 7 percent of respondents recouped 100 percent of lost revenue.

Generating revenue from virtual or hybrid events is certainly a hot topic, and we’re addressing it on our next webinar, hosted in partnership with MeetingPlay with a focus on hybrid events.

The Positives

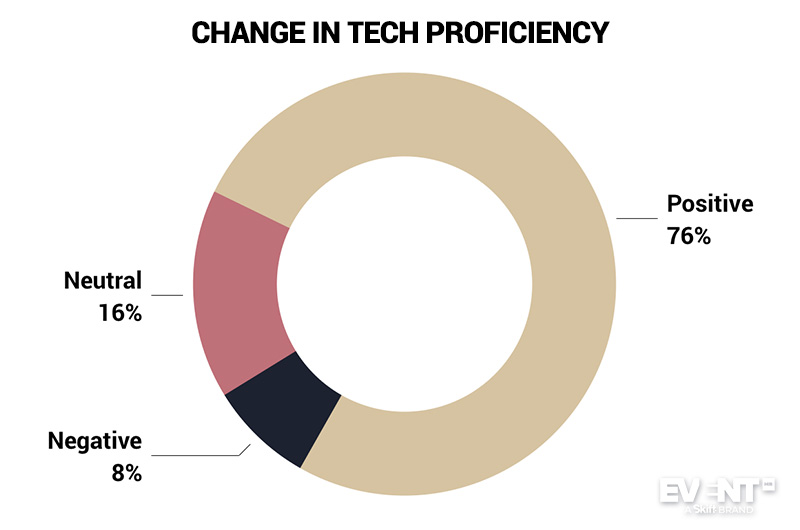

Fortunately, it’s not all doom and gloom. Our research confirms that the pandemic has had a positive impact on tech proficiency with 76 percent reporting progress in this area, and only 8 percent feeling a reduction.

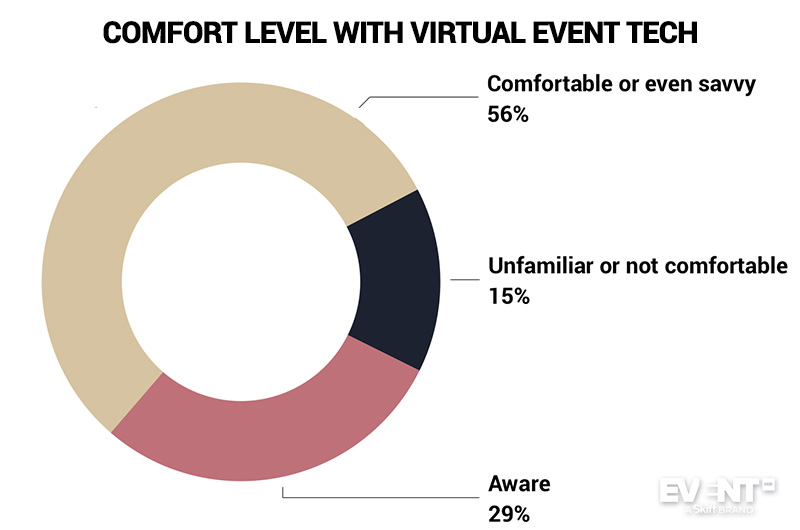

Similarly, when it comes to virtual event tech, more than half, 56 percent, are already comfortable or even savvy, and only 15 percent feel unfamiliar or uncomfortable with it.

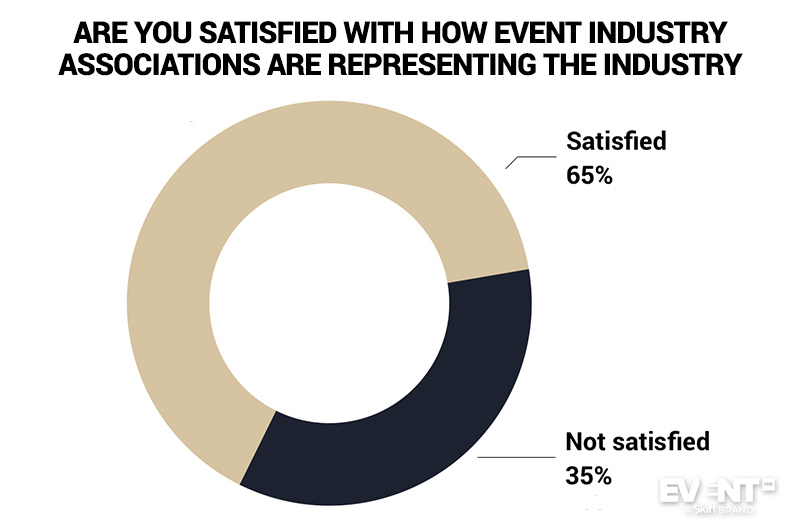

It’s also worth noting that despite the challenging times for the entire industry, a clear majority (65 percent) of respondents stated that they are satisfied with how event industry associations are representing the industry and dealing with the crisis.

The Future

Looking to the future, we see a small but positive shift for major events going ahead in person. While only 4 percent were able to host their last major event in person, 16 percent report looking to host the next major event. With this data collected during a significant shift in outlook based on mass vaccination, we are hopeful that we will see this movement progress positively.

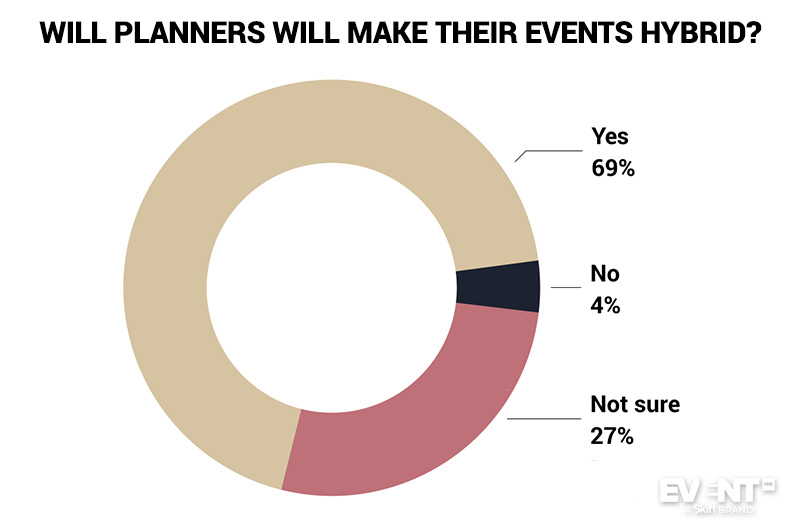

While we are likely to see an uptick in in-person events, 44 percent believe that events will be smaller in size. The hybrid approach is looking the most likely with 69 percent heading in this direction, 27 percent on the fence, and only 4 percent of respondents going against the hybrid trend.

What hybrid events will ultimately look like continues to be hotly debated, and it looks much more likely that virtual and in-person audiences will have separate and dedicated experiences. A whopping 94 percent of respondents felt this was what hybrid events would look like in agreement with our recent story that questioned the need for integrated experiences.

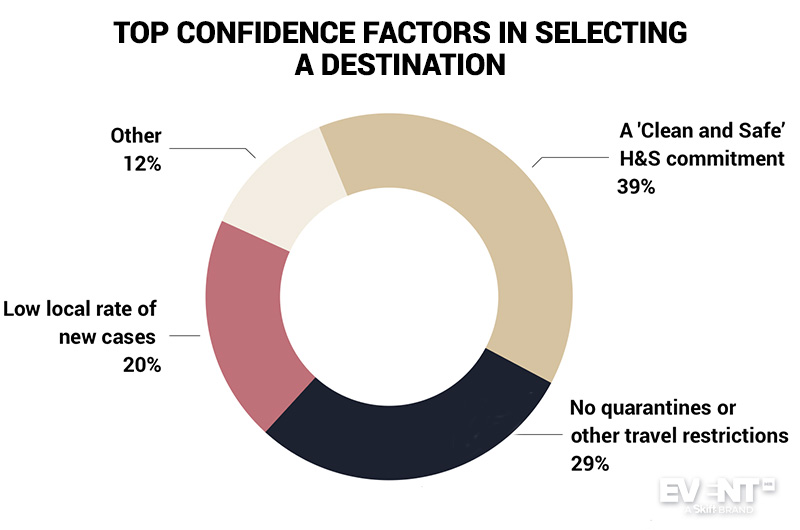

For those destinations supporting the planning of in-person events, it is worth noting the top confidence factors in selecting a destination. A ‘Clean and Safe’ type of designation is the most important with 39 percent selecting it as top choice, followed by a lack of quarantines or travel restrictions (29 percent) and a low local rate of new cases (20 percent).

IN CONCLUSION

Global Meetings Industry Day seems like a fine occasion to take the industry’s temperature, and it seems to be warming after the long, cold night that was 2020. With the promise of mass vaccinations on the horizon, the industry is starting to look optimistically towards an onsite future that is heavily supplemented, at least in the short term, by a dedicated virtual experience.

And while event professionals have yet to work out all the kinks in virtual events, they have come a long way and are constantly improving. Their longevity will ultimately depend on improvements to relevant business models and revenue-generating opportunities, as well as the encouraging trend of event professionals becoming more tech proficient.