Emburse: Take Control of Event Costs [Review]

Skift Take

Emburse: What Is It?

Emburse enables teams to keep track of event costs in real time through real or virtual payment cards that enforce a set budget. Rather than having a complex purchase order process or relying on individual team members to record all expenses in a timely and accurate manner, Emburse allows you to see exactly how much has been spent towards a specific project budget through the use of its virtual and physical debit cards.

Keeping a tight control over event expenditure is essential for a healthy event, but frankly it can be a drag submitting receipts and often it can be weeks or months after an event until all the expenditure and small receipts have been accurately reconciled. When the event is over it is too late to make adjustments and get things back on track. Having live data could make the difference between your event being profitable or making a loss.

Knowing how essential the financial management is and how it makes many busy event planners groan and sigh I was interested to learn more about this tool and how it works.

The Main Categories of Features Are:

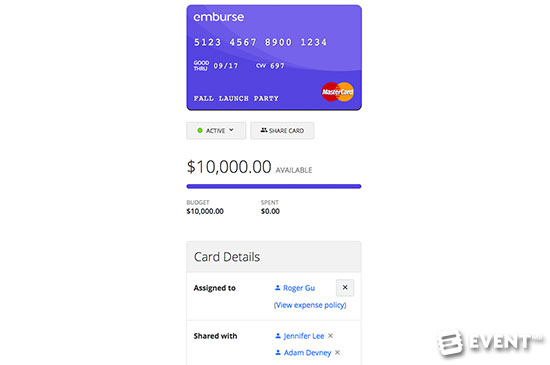

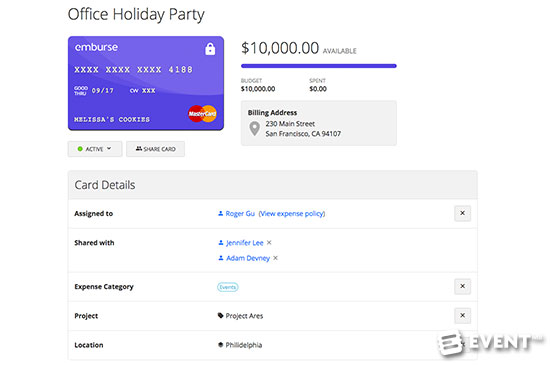

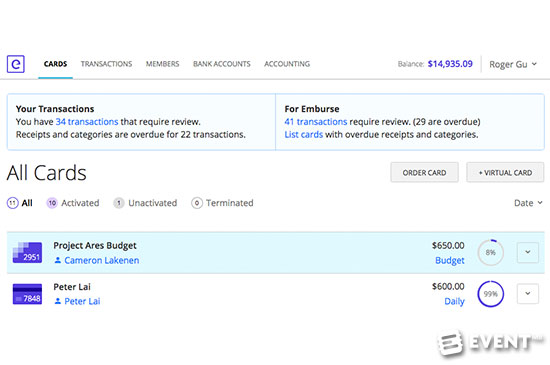

Physical and Virtual Cards. Instantly create and assign virtual cards to be used for payments instantly, or request a physical card despatched within five days.

Budget Tracking. Link virtual cards to give all team members and authorized suppliers access to a single budget. Coordinate and review spending for a single event or project in real time.

Expense Reconciliation. Capture receipts on mobile and desktop and push data to accounting software.

Review

Emburse works like a powerful bank account to coordinate complex budgets. It aims to make it easier for teams to coordinate and will be particularly valued by those that have a history of going over-budget or those wanting to put stricter controls in place.

Budget Controls

The tool allows you to set daily, monthly, and fixed project limit, which cannot be exceeded. You can apply restrictions such as a maximum limit per transaction or specify that payments are only authorized for certain types of payments, for instance hotels or gas.

There is no chance of going over the budget that has been set but it can be updated in real time, with managerial approval, if changes need to be implemented. Likewise you can instantaneously suspend or reinstate payment cards.

Currently Emburse does not offer credit or net 30-day payment terms. Funds must be loaded or pre-authorized before the purchases are made. Non-Emburse cards cannot be added or tracked through the system and physical Emburse cards can’t be linked like virtual cards can. Physical payment cards can only be shipped within the US currently, however virtual cards are available for use worldwide.

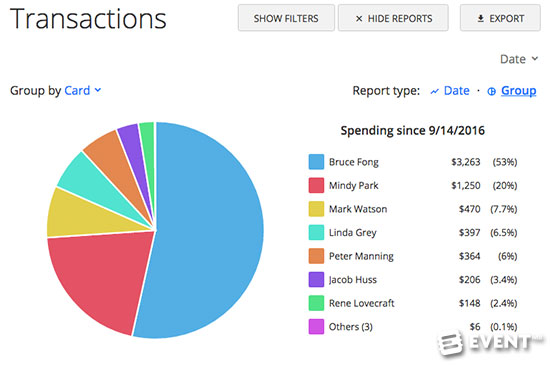

Real Time Transactions

Additional members can be added to an account simply with an email address. If you have clients or contractors that need access it is quick and easy to set them up. All members can then see the transactions in real time. Emburse cards are accepted wherever Mastercard is accepted (virtually everywhere!). Virtual cards can be used online and in the future they will integrate with Apple Pay and Google Wallet too, which is pretty cool.

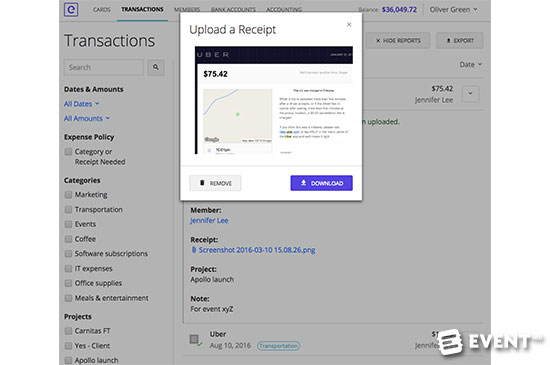

Receipts

Emburse has a built-in expense reconciliation system to capture receipts and categorize transactions seconds after a transaction. Receipts can be added on the fly by taking a picture of it from your mobile device. Emburse will also try to find the receipt in your inbox automatically, meaning that you don’t necessarily have to do anything to reconcile the payment!

You can require receipts to be submitted for every transaction or only for transactions of over $75, depending on your organization requirements or preferences. When a transaction is made the person making the payment receives an immediate reminder if a receipt is required, which gives the opportunity for it to be submitted to the system immediately while the receipt is in your hand or can still be accessed from the cashier. You can of course add the paperwork at a later date if you prefer and this will show as “Requires Review” for the transaction.

Expense Allocation

Up to three default tags can be set for all transactions by expense category, project, location, or any breakdown information that you require. You can of course override the default tags when you need to or not allocate default tags so the information is completed on a per transaction basis. Notes can be added and stored against transactions too.

You can see pie charts giving a breakdown of the expenditure for greater visual analysis.

Accounting Software and Integrations

Emburse integrates with a variety of accounting suites including Expensify, Netsuite, Quickbooks and Xero. Data can be exported to CSV or Excel, which is accepted by any accounting software.

It is the first open corporate API. The Emburse API can enable the creation of expense cards at scale for custom business solutions and third-party app integrations. It can even integrate with Slack to request a new card for a specific amount. When an administrator approves, a virtual card is created instantaneously and shared via Slack.

Features

Physical and Virtual Cards

- Instant card creation

- Virtual cards can be set up and used for payments instantly

- Physical cards come in the mail in less than 5 business days (USA only)

- Cards can be created with a fixed or recurring budget (weekly, monthly, etc) and assigned to someone with just an email address.

Budget Tracking

- Virtual cards can be linked, so that multiple individuals get access to a single budget.

- Link suppliers, contractors and clients who are authorized for expenditure from the event budget

- Coordinate budgets for a single event, project, etc. in real time

- Managers can review and adapt spending limits as required

Expense Reconciliation

- Capture receipts on mobile and desktop

- Add data on the go

- No lost receipts

- Admins and users can set default tags for their transactions based on:

1) expense category

2) team

3) project/client

4) location

- All data can be seamlessly pushed to accounting clients such as Quickbooks Online, Netsuite, and Xero

- API for automation and large team management

Who Is It For?

Emburse primarily caters for teams with distributed workforces that need to tightly coordinate budgets. It can be used to control office expenses, as well as being ideal for larger event management projects.

Pros and Cons

Pros

- Coordinate expenses across team-members anywhere, anytime. Built in expense reconciliation and receipt capture is great for teams on the go and real time data

- Strict budget rules that can be enforced, but also adjusted with managerial approval

- Works with a wide variety of accounting suites

- Emburse cards are usable everywhere Mastercard is accepted

Cons

- Currently Emburse does not offer credit/net 30 days payment terms. Funds must be loaded before the purchase

- Non-Emburse cards cannot be added

- Physical cards can’t be linked like virtual cards can

- Physical cards can only be shipped to the US currently

Pricing and Plans

The standard pricing is $15 per active user per month for the first 20 users, then $5 per user per month thereafter.

In Conclusion

Event budgets can be complex and difficult to keep track of in real time. Emburse empowers event teams to be in control of their expenditure. Request a demo or find out more about Emburse.

Disclaimer: Reviews are paid for placements. While Event Manager Blog receives a fee to extensively look at the tool and review it in detail, the content of the review is independent and by no means influenced by the company. If you have any questions please use the contact us section.