Skift Take

Meetings industry associations are shifting and morphing with more seismic change predicted. What associations will be impacted and when?

Meetings industry associations stand at the precipice of what many perceive as long overdue change. Some remain on shaky financial footing as they try to recover from the Covid pandemic. Others have fallen short in at least one of the key areas most important to a thriving association — innovation, advocacy, and education. Add to that a need for more unity and younger attendees, already skeptical about joining any formal group, and you have a landscape ripe for change.

While all these associations filed their non-profit paperwork with a clear mandate, times and needs change, especially with a global pandemic, industry associations need to meet this new landscape.

Australian Associations Shows How It’s Done

Three meetings industry associations recently merged in Australia. The Association of Australian Convention Bureaux (AACB), the Australian Convention Centres Group (ACCG), and the Exhibition & Events Association of Australasia Ltd (EEAA) merged to form the Australian Business Events Association (ABEA). “The industry has been on the fringe of the government’s radar for too long. Covid taught us that we need to get serious about amplifying our collective voice,” said Peter King, independent chair of the ABEA board.

UFI CEO Kai Hattendorf was one of several industry insiders who applauded the consolidation of Australian associations. “This is a prime case study on our industry re-aligning nationally and re-shaping an association landscape to better support the members and the industry,” said Hattendorf.

Many now wonder if similar consolidation will expand globally, with some asking not if but when.

Egos Hold the Industry Back

Hattendorf recently made waves when he posted about what impedes the meetings industry on the UFI blog. “A room full of association and policy leaders were asked to state what is holding our industry back. The results were shown in a cloud of words. One of the biggest terms ‘industry egos.’ A timely reminder from within our global industry leadership that getting things done needs frameworks and structures, but mostly the willingness to walk together, not alone,” he wrote.

Walking Together, Not Alone

PCMA has been making moves for some time now with the acquisition of the Event Leadership Institute (ELI), the Event Marketing Association (EMA), and the Corporate Event Marketing Association (CEMA). This is just the beginning.

Sherrif Karamat, president and CEO of PCMA, said that his organization has four acquisitions and two joint ventures in the works.

In some cases, Karamat said, associations acquired should keep their brands, much like PCMA has done with CEMA, which PCMA owns and powers. “It is about being able to provide greater value to the industry and consolidate how we provide that value,” Karamat added.

In Karamat’s view, many associations began by fulfilling certain roles in specific verticals. But, as the meetings industry evolved, their roles increasingly overlapped. “Organizations are feeling the pressure, where the demand for their organizations is not there because they’re not providing the value, or the value is being provided somewhere else, or there’s too much duplication,” said Karamat.

He added that these issues become even more blurred because of what he sees as an undesirable influx of for-profit companies into this space. “What’s happening is more fragmented because the conferences and events are not necessarily coming from associations. They’re coming from for-profit entities that are not necessarily serving the good of the profession,” said Karamat.

The Sustainability Advantage

Too many redundant conventions mean the environment takes a hit, yet forging several together means less travel, one of the most effective ways to reduce one’s carbon footprint.

“Instead of doing ten things, we try and do one thing together. And that in and of itself is respectful of people’s time, resources, and the commitment to doing everything in one place as opposed to having to make six trips instead of one,” said Karamat.

While sponsors look positively at consolidating conventions, fewer live events mean less business for suppliers working on these shows. Nevertheless, Karamat believes this is the right course of action. “It should not be driven because a part of the supply side feels that they are funding it more. It should be driven by the fact that there’s duplication and there’s no need,” said Karamat.

What Future Consolidation Could Look Like

Outgoing IAEE president and CEO David DuBois used Marriott’s $13 billion acquisition of Starwood as a metaphor for possible meetings industry consolidation. “Basically, what did Marriott do? They consolidated and bought out their competition,” said DuBois. “Would PCMA have the financial wherewithal to buy MPI? Or would MPI have the financial wherewithal to buy PCMA? Would UFI or SISO want to buy? Or would I want to buy out the other two and just have IAEE exist, or would UFI want to do that?”

UFI’s Global Congress heads to Las Vegas in November, just one month before IAEE’s Expo! Expo! in Dallas. UFI’s core membership is outside of North America. With IAEE, it’s the opposite. UFI has made no secret about boosting its North American membership, but could consolidation be on the horizon?

While the number of industry association gatherings continues to grow, sponsorship funds are not flourishing alongside, leading DuBois to wonder if this might drive at least some consolidation. “Because if you don’t have the sponsorship dollars, how will you have the meeting?” he asked.

Semantics is important, adds DuBois. “Consolidation is similar to a merger, but does that mean you legally consolidate? Then there is collaboration. SISO and IAEE should be very collaborative because we are in the same space. PCMA, MPI, and RCMA (the Religious Conference Management Association) should be collaborative, and in some ways, they aren’t, but they are all members of EIC. That’s collaboration,” explains DuBois.

Some say the evolution has already started. DuBois will step down as the president and CEO of IAEE at the end of September. David Audrain relinquished his role as SISO at the end of last year, and Vinnie Polito took over on January 1.

With a generation of leaders turning over, is this the opportune time for acquisition?

Collaboration as an Alternative

While consolidation may be looming, the Meetings Industry Council of Colorado (MIC of Colorado) has brought together 13 member associations for the last 20 years. Together they run one joint trade show for 1,200 attendees, including 400 planners. “We realized we were all vying for the same sponsors and attendees. That was one of the reasons why we decided to come together and do one trade show together,” said Dean Savoca, past chair of the MIC of Colorado.

Although a successful model, it is not one without challenges. Replicating the model in other regions may not be straightforward. “We have been contacted by other states interested in coming together as we have. It’s not easy. There is pushback from some. It takes authenticity and the belief that we are stronger together to make it happen. Everyone has to leave their egos at the door and put the industry above all else,” said Savoca.

Advocacy Unites

The need for industry advocacy during the Covid pandemic was also a powerful unifier. The Exhibitions & Conferences Alliance (ECA) emerged from advocacy efforts that brought together ten separate industry bodies.

Created in February 2021, this critical alliance grew out of the efforts of Go LIVE Together, a coalition of 80 partners that joined forces to support legislative actions to help the industry recover from the Covid pandemic.

Business Events Industry Week is another example of three organizations joining forces around advocacy. The event builds on a partnership between Destinations International (DI), IAEE, and PCMA. This year, they were joined by ASAE, the AMC Institute, EIC, and the National Coalition of Black Meeting Professionals (NCBMP).

Generational Shift Drives Association Evolution

Younger attendees are making an impact on industry associations as well. “We have all seen the statistics about the younger generation leaving associations. During Covid, living with intention became a focus. So did the idea that less is better. People are pickier with their time. Today, people don’t want to attend an industry conference just for the sake of going,” said Savoca.

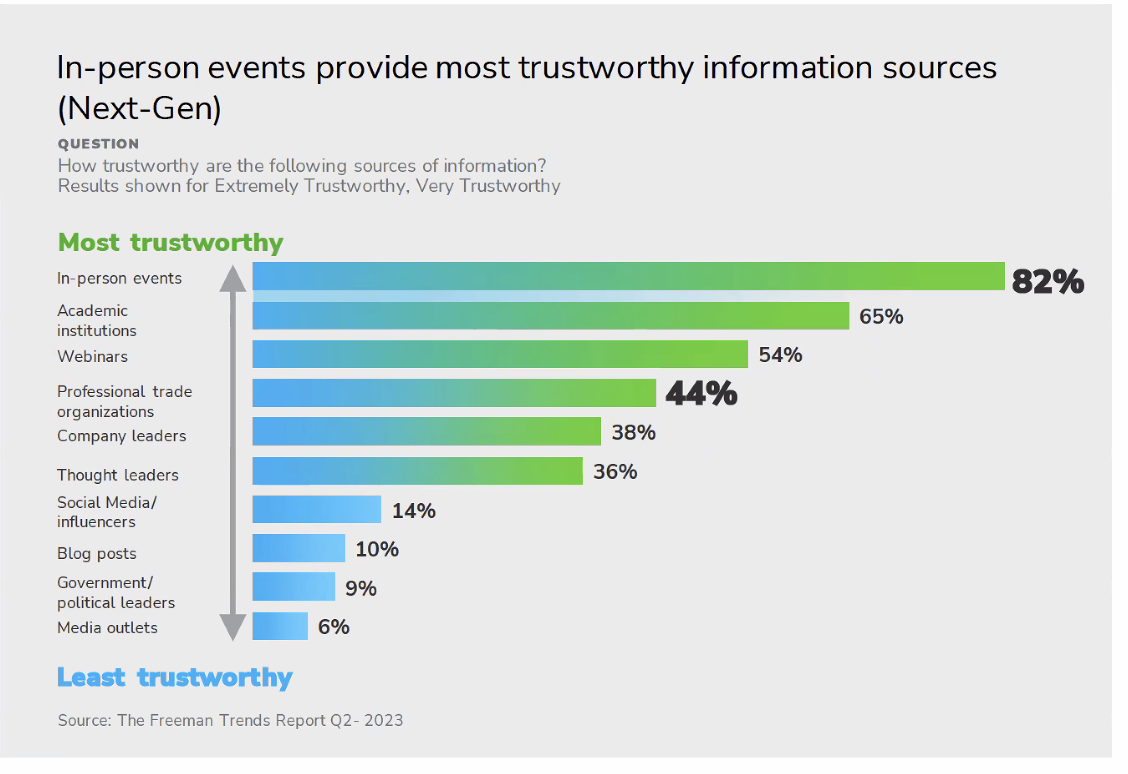

Research backs this up. The latest Freeman Trends Report asks about the trustworthiness of information sources. When asked of participants of all ages, professional trade organizations ranked 68%. When directed at today’s Next Gen Event Goer, between 20 and 44 years old, that number declines to 44%.

Ken Holsinger, senior vice president of strategy at Freeman, often asks industry gatherings how many in the room think their kids will join the Elks or the Rotary. No one raises their hand. “These organizations have failed to translate and offer value to the next generation,” said Holsinger. “The idea of an 18-year-old joining them is a foreign concept. It is important for an association of any kind to translate generationally the idea of a club to a community.”

This also relates to strategic focus. If a conference tries to be all things to all people, it may end up being nothing to no one. But when an event is clearly aligned with its mission and focus, it benefits all. “Associations can come together and be stronger as long as their strategic purpose is the same,” added Savoca.

Industry experts predict the number of industry associations will look much different in five years. The bottom line is that the industry is evolving, and the Australian consolidation may be the precursor for what is ahead in North America.

Photo credit: Midjourney / Prompt: board meeting with older men and women in room with no windows, contracts and other papers on table