Clarion Events Expands Energy Portfolio with Acquisition of Infocast

Skift Take

Clarion Events has acquired Information Forecast (Infocast), a renewable energy event organizer. Infocast’s events will become part of Clarion’s energy portfolio, which has grown significantly over the past several years.

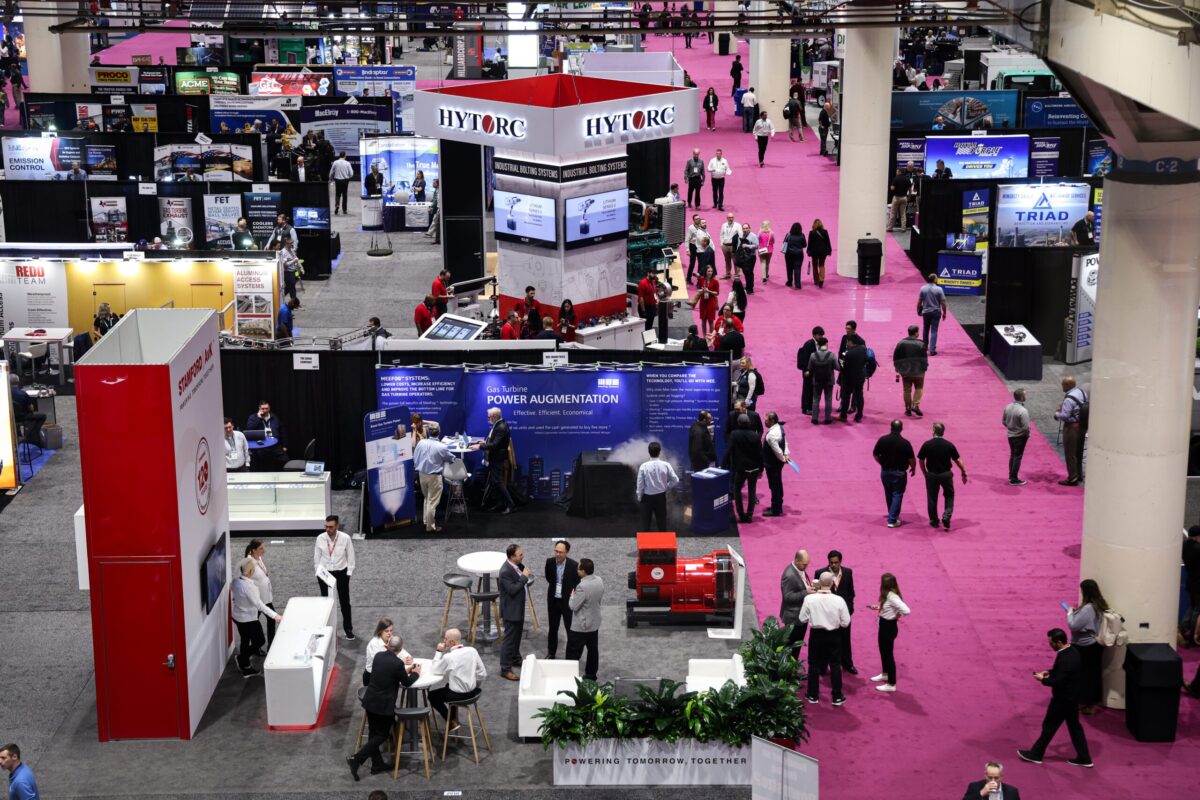

Clarion’s portfolio includes shows like Distributech International and regional development-focused events GridTech Connect, Powergen International, Enlit Europe, Enlit Asia, and the African Energy Forum.

Some of Infocast’s events include Southeast Renewable Energy, Mountain West Renewables, Ercot Market Summit, and Solar + Wind Finance and Investment Summit.

Clarion Events North America is the U.S. division of Clarion Events, UK. It is backed by The Blackstone Group. There are 2,000 employees based in 12 countries.

Does Clarion have plans to buy other organizations? “We recognize that today’s evolving market opens the door for strategic acquisitions and mergers and have our focus on how we can complement our current portfolios as well as broaden our reach in industries and geographies,” said Liz Irving, president of Clarion Events North America.

This acquisition follows the recent launch of The Clarion Collaborative: Elevating Association Events. This partnership focuses on helping associations with event strategy and management.

It is also one of a recent flurry of acquisitions in the industry. Just this week the Hyve Group announced it is acquiring HLH, a UK-based global event company for international health innovators.

Last week, Truelink Capital, a Los Angeles-based private equity firm, acquired GES Exhibitions, a global exhibitions and logistic services company.

Not only have there been acquisitions, but also an injection of private equity capital. Recently, New State Capital Partners acquired a majority stake in The Expo Group. Another deal involved CloserStill Media acquiring a majority stake in Partnership Network Events. That followed Phoenix Equity Partners investing in Nineteen Group.

Then there is Shamrock Capital replacing MSouth Equity Partners as trade show planning, labor management, and events company Nth Degree’s new investor.

One of the biggest acquisitions of the year was Maritz acquiring Convention Data Services (CDS), a registration, on-site and lead management company from Freeman.