Reach was cited by most planners as the most promising benefit of virtual events. Most B2B events, from corporate user conferences to association trade shows, rely on reach to maximize their stakeholders’ longtail ROI in the form of future conversions. In virtual events, the focus is less on direct profit from the event itself, and more on future revenue from sales down the line.

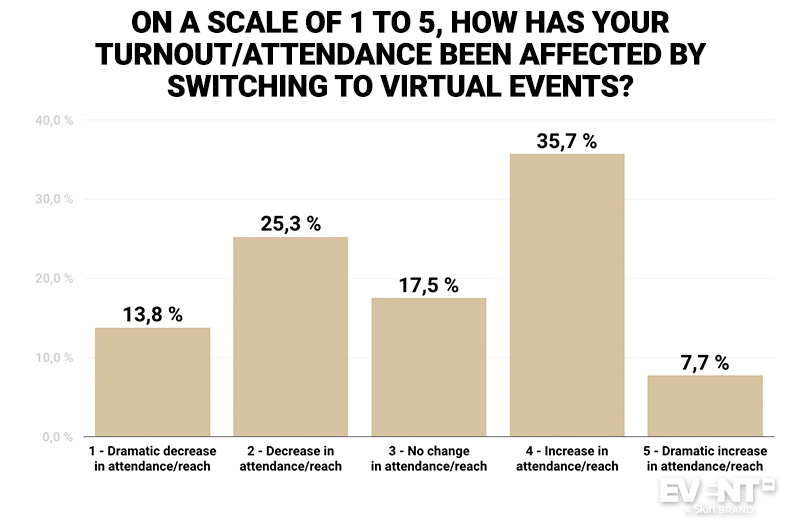

But if EventMB’s latest research is any indicator, virtual events have yet to deliver on the promise of a higher reach. Less than half of EventMB’s recent survey respondents reported an increased reach, and almost as many actually reported lower attendance — a figure corroborated by the consistently highest-ranked challenge associated with virtual: engagement.

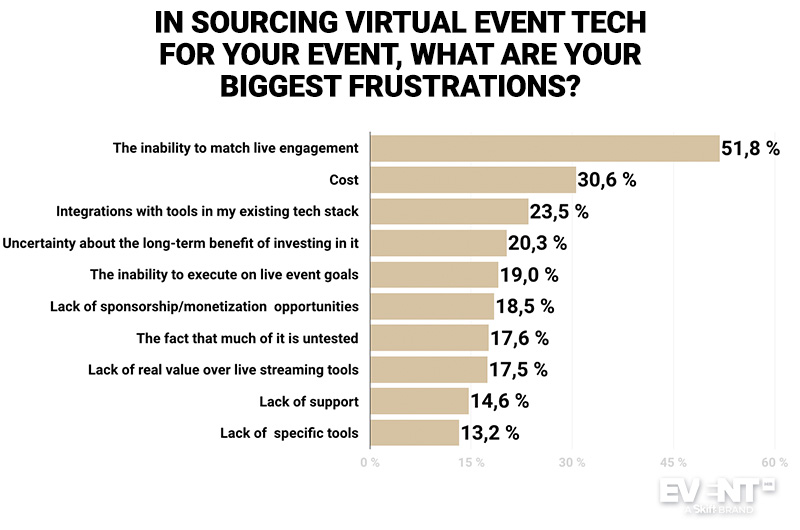

To compensate, planners remain timid in terms of charging for virtual. Only 16 percent cited ticketing as their primary source of revenue, and nearly a third indicated that their events were free. Although these figures could partially be explained by internal corporate events that wouldn’t normally charge, there are other worrying signs. Only 7 percent of our respondents expect to recoup 100 percent of their pre-pandemic revenue through virtual events. Given these statistics, it’s no surprise that close to 19 percent of respondents cited the lack of monetization opportunities as one of their biggest frustrations with event tech.

The real problem is that ticket fees create a barrier to entry, which in turn may discourage the kind of traffic that sponsors and corporate stakeholders count on to fill their pipelines. On the flipside, even organizers who are primarily focused on longtail conversions could benefit from higher event revenues.

Is there a way to bridge these seemingly incompatible goals? The eGaming industry has mastered the art of generating income without undermining engagement, and it could be the model to follow for effective virtual event monetization.

The Trade-Off Between Reach and Revenue

Not everyone agrees that the eGaming model is the right path forward. EventMB spoke to SpotMe CEO Pierre Metrailler, who has been a vocal proponent of making reach the highest priority in the shift to digital formats.

The tendency to see events as a form of digital marketing is an inevitable consequence of moving them online. Virtual space removes the need to consume event content during the live stream, and Metrailler estimates that 80 percent of it will be viewed on demand.

That’s fine, says Metrailler. The real opportunity lies in the potential for brand engagement. Even when it comes to events that have traditionally generated revenue, planners need to take a page from the digital marketing playbook: Their ultimate objective should be looking after their event stakeholders’ interests. What do sponsors care about? Deals that come from event exposure. What do corporate clients care about? Deals that come from their user conferences. In both cases, the potential revenue from the event itself pales in comparison.

“The amount you can make down the pipeline is an order of magnitude greater than what you can make from ticketing, microtransactions, or other direct revenue from the event.”

– Pierre Metrailler, CEO, SpotMe

Therefore, anything that obstructs lead generation should be avoided, maintains Metrailler, and that includes any form of monetization where attendees foot the bill: “If you want to increase your reach, why would you want to sabotage yourself by asking for payment?”

However, monetization remains a priority for many planners — even if just as a hold-over from the expectations set by live in-person events. Some events may be responsible for generating revenue, and even those with no such expectations have traditionally at least tried to break even.

Moreover, if in-person attendance is considered worth the ticket cost, are we perhaps underselling the value of virtual events by offering full access at no charge?

How eGaming Business Models Monetize Engagement

Gamification has long been in the sales kits of event tech companies catering to B2B events, but the full potential of the trend has not yet been realised. In particular, there may be more to learn from the eGaming industry. If nothing else, eGaming proves that going digital doesn’t have to mean sacrificing revenue. What seems like nothing more than fun and games is actually big business.

AVOID TICKET FEES BY UPSELLING WITH MICROTRANSACTIONS

What is perhaps most surprising about this monetary success is that it relies less on a pay-to-play model, and more on the monetization of engagement itself. How? Microtransactions.

The term “microtransactions” refers to small payments that are associated with some kind of benefit on a gaming platform. In some cases, they allow players to advance more quickly in a game. In others, they give players the ability to make cosmetic customizations to their avatars, such as a special costume or a “skin.” And many gaming companies rely primarily on this form of payment to stay in business. The King gaming company, for example, was able to remove all ads from its games in 2013 thanks to the much more lucrative revenue stream generated from microtransactions.

And it’s not just the eGaming companies that are making money. Some gamers like to watch other people play, and those who draw the largest audiences are actually able to generate revenue from their viewership. Just as with the game manufacturers themselves, eSports players rarely charge for access to their content. Instead, they set small fees for minor perks, shout-outs, or special effect activations.

CHOOSING THE RIGHT EVENT BENEFITS TO MONETIZE

Could events use a similar system, charging micro sums for special event features?

Alex Plaxen, who has a foot in both worlds, thinks the eGaming and eSports models could work for virtual events. Known to many as the president and founder of Little Bird Told Media, Plaxen recently branched out from his event marketing business to build an online presence as a content creator on Facebook Gaming. And in less than half a year, he has already built enough of a fanbase to count on a reliable income stream from his gaming.

Plaxen thinks that virtual events could borrow from the idea of “skins” that players use to customize their avatars in eGames. “If you don’t want the virtual event platform’s basic avatar, you could customize it with microtransactions,” he suggested. “There are cosmetic upgrades that could be useful for someone trying to network or raise their profile.”

Nick Borelli, director of marketing growth at AllSeated, agrees that networking perks have the highest potential for monetization, but he has a different take on how the benefits would be delivered.

“There’s a lot of pushback from the B2B community in embracing the more cutesy aesthetics that are popular in other areas. I personally wouldn’t spend a nickel to change my avatar at an association event, and oftentimes it’s not even my nickel to spend. Microtransactions would have to be tied to benefits that accelerate sales.”

At B2B events, most attendees are there at the behest of their employer, and their purchases have to be justifiable on a corporate expense statement. Accordingly, Borelli thinks it would be easier to upsell attendees with benefits like access to gated networking activities. If it brings them one step closer to striking a deal with a high-stakes investor, it’s an easy sell.

Borelli also suggested adopting a “freemium” approach, wherein attendees could access a set number of sessions for free. Once they hit their allotted limit, they would then have the option to attend additional sessions under a pay-per-view microtransaction system.

Plaxen similarly suggested charging a small fee for the opportunity to ask a direct question to a high-profile speaker, and himself uses a freemium stream as part of his gaming strategy to funnel a segment of his audience into a more exclusive channel for monetized content. Behind the paywall, subscribers might get a combination of unique content and early access to freemium content.

HOW TO MINIMIZE THE FRICTION OF A PAY STRUCTURE

In Metrailler’s view, however, the simple hassle of inputting payment information would make attendees think twice about opting in. “The friction with microtransactions is the transaction itself,” he explained.

In the case of event apps downloaded from the App Store or Google Play, the attendee will likely have already approved the use of their payment information for in-app purchases. But the same cannot necessarily be said for event platforms accessed through a web browser.

Could charging a nominal fee to enter the event be the solution? Metrailler thinks that this approach would inevitably lead to a smaller event turnout, which would ultimately hurt the higher-priority goal of maximizing market reach.

But there may be another way to get around the issue. Most eGaming and eSports platforms make use of a token system that functions like a virtual currency. Users provide their payment information once, and then they can later choose to top up their tokens with a simple click.

How could a virtual currency system help to reduce the friction involved with payment? If virtual event platforms function like 365-day communities, attendees could carry over their tokens from event to event — and they would only have to enter their payment information once.

Plaxen believes that virtual event platforms could perform a similar role to eGaming and eSports platforms: “You have the audience. You are the Facebook Gaming. You are the Twitch.”

Further, for those who want to avoid a payment system altogether, there is always the option of incorporating tokens into event gamification. Instead of paying for tokens, attendees could earn them by completing challenges that serve sponsor goals. For example, they could earn ten tokens for watching an ad or completing a sponsor survey. A similar principle is already being used in eGaming, with players rewarded for watching in-game ads. And just as these players can use their additional points to advance in the game, attendees could use them for perks like access to an exclusive networking event.

Similarly, exhibitors could sponsor a set number of tokens per attendee — or award them to their most promising leads.

Plaxen even foresees that tokens could be used to tip presenters in the same way that Facebook Gaming allows viewers to tip their favorite players with “stars” (the platform’s virtual currency). Content creators on Facebook Gaming collectively earned a total of $50 million last year through this star system. Plaxen asked, “Wouldn’t speakers participate at a lower rate if the people watching them could tip them?”

How to Drive More Revenue From Sponsors

A number of other eGaming monetization strategies — such as advertising revenue and subscription models — have already been embraced by some event organizers, and the shift to virtual will likely accelerate this trend. Metrailler’s platform, for example, is currently developing a pay-per-click (PPC) advertising option.

For minimal disruption of the attendee experience, Metrailler envisions placing highly relevant ads within the chat feature during the live stream. Following a model similar to YouTube’s, these sponsor reels and CTAs could then appear in on-demand content as interstitial ads. But unlike with YouTube ads, event organizers can charge big bucks for each click because their audience typically represents a niche, qualified market.

Metrailler believes that as long as the ads are relevant to their interests, attendees will welcome them. Attendees watching a panel discussion on sustainable event practices might welcome a CTA from a company that manufactures compostable serviceware. According to Metrailler, the opportunity to indulge their curiosity might actually help to keep attendees more engaged:

“There’s a lot of talk about attendees being distracted at virtual events — even at live events they looked down at their phones. How about we distract them constructively?”

– Pierre Metrailler, CEO, SpotMe

IN CONCLUSION

If event organizers want to synchronize monetization and engagement, microtransactions and virtual currencies may be a constructive step forward. In terms of more traditional methods like advertising, there may also be room for further innovations.

As Borelli pointed out, “A complicating factor is that there wasn’t a lot of intentional design put into play in 2020 because everyone had to pivot so quickly.” There are already signs of improving engagement rates, and it may be only a matter of time before virtual events become more profitable.